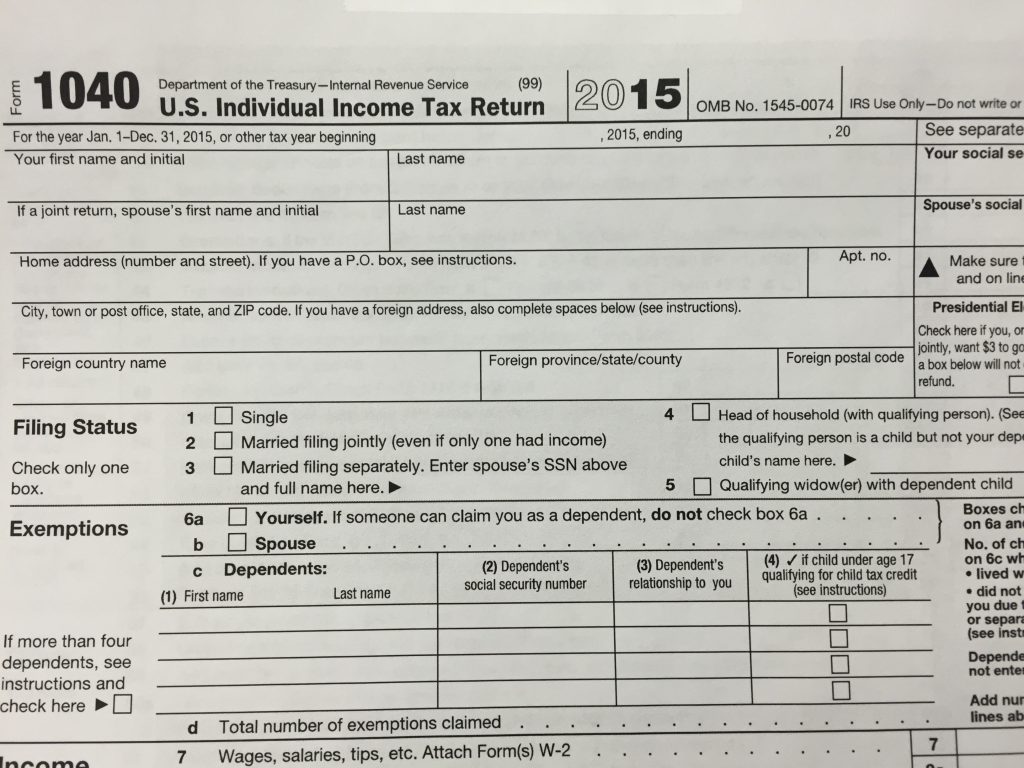

IRS Tries to Stay One Step Ahead of Crooks [REPORT]

Hackers work hard to steal your tax info. IRS says it works harder to stop them.

A new study says some tax preparation companies take advantage of people who qualify for the federal Earned Income Tax Credit by charging them hundreds of dollars to do their taxes. Marketplace’s Mark Garrison reported on the study from the Progressive Policy Institute last week. The Internal Revenue Service offers free tax filing for people with low-incomes. But IRS spokesperson Luis Garcia tells WDET’s Pat Batcheller Congress blocked efforts to let the agency regulate tax preparers. Click on the audio player to hear the conversation.

More income tax coverage from WDET:

More from Marketplace:

Tax preparers prey on low-income filers, study says

It’s tax time–and time for tax scams