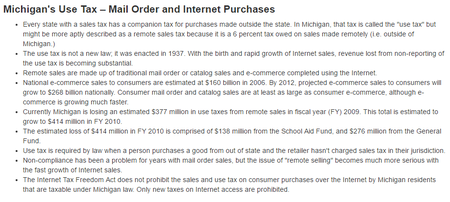

Don’t Forget the Use Tax When You Shop Online

Michigan Treasury says state loses at least $200 million in revenue to online sales.

Michigan’s Department of Treasury estimates the state loses at least $200 million a year when shoppers buy merchandise online. That’s because retailers who don’t have a physical presence in the state—such as a store—don’t have to collect the six percent sales tax. Instead, consumers who buy things online have to report and pay a six-percent use tax. Glen White is Michigan’s Deputy Treasurer for Tax Administration. He tells WDET’s Pat Batcheller it would take an act of Congress to require out-of-state retailers to collect the sales tax.

“The U.S. Supreme Court has held that the Constitution reserves the right or ability to regulate interstate commerce to the Congress, and so Congress would have to permit that,” White says.

White says consumers should keep track of their online purchases and estimate how much they owe in sales taxes, then report the amount when they file their Michigan income tax returns. Click on the audio player to hear the conversation.