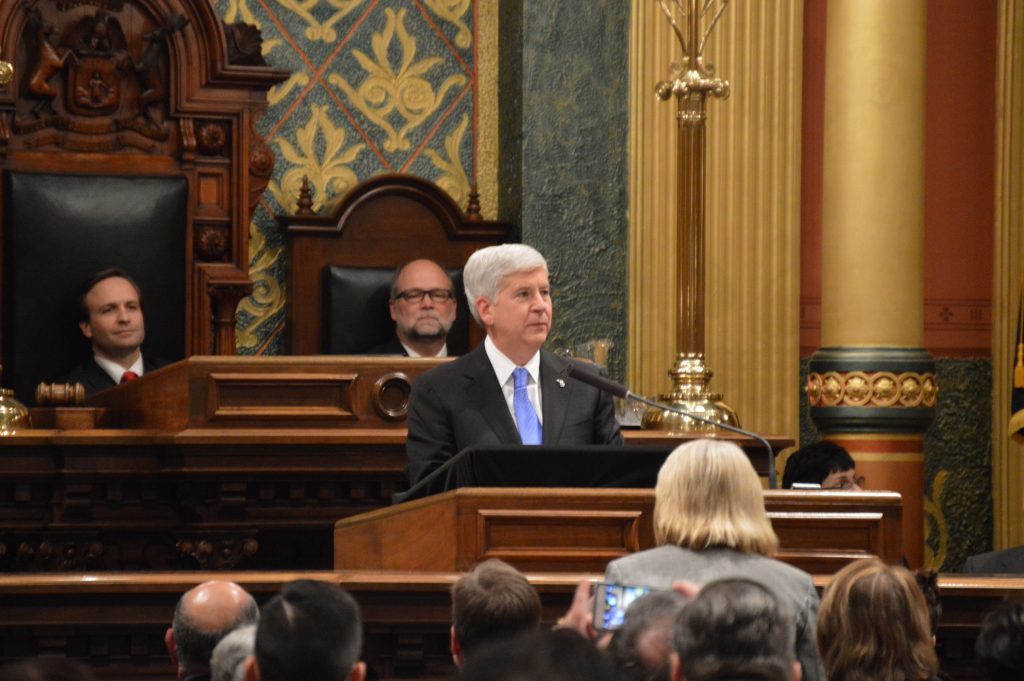

Snyder Signs Tax Cut, Says State Can Afford to Fix Roads and Cut Income Tax

The tax cut amounts to about $25 per taxpayer. It will cut up to $180 million in state revenue.

Gov. Rick Snyder signed legislation on Wednesday that ensures the personal exemption on state income taxes will not disappear as a result of the new federal tax law.

The governor says the state can handle a tax cut and spending more to fix roads.

The new law amounts to a net tax reduction as the state is scrambling for revenue to fix roads. The tax rollback will cut up to $180 million in state revenue.

Snyder says there’s still enough, though, to put another $175 million this year into road funding.

“And we’re going to keep having more resources to put in our roads,” said Snyder. “We can do both. We just need to be smart about doing a balance of things.”

“So is it going to fix every pothole in Michigan? No,” he continues. “But we’re making major steps forward.”

But the governor also says it will be tough to keep up with the damage caused by the frequent freezes and thaws and flooding this winter.

“I think we’re making progress there,” said the governor. “I just wish we didn’t have the freeze-thaw cycle we did this year because this has been a particularly tough year.”

The tax cut amounts to about $25 per taxpayer.