Buyer Assistance Programs Aim to Increase Home Purchases in Detroit

Detroit’s housing market has suffered as a result of cash sales

In 2014, Becki Kenderes and her boyfriend were living in a basement apartment beneath a house in Detroit.

“It was totally underground, no windows,” she remembers.

When she saw a bungalow for sale on the city’s northwest side – and it had a bath the size of a hot tub — she knew it was time to trade rent for a mortgage. The couple now owns that house in the Grandmont Rosedale area, and they don’t go in the basement unless they have to get something from storage.

A STAKE IN SOCIETY

“The ambition to own one’s own home is shared by virtually all Americans.”

Those words were written by the National Advisory Commission on Civil Disorders in 1968, which determined that owning a home was not just aspirational, it was important to maintaining civil order and functioning neighborhoods.

The Commission – widely known as “The Kerner Commission” after its chair – then-Ill. Gov. Otto Kerner, Jr. – was convened by President Lyndon B. Johnson to investigate and offer recommendations for the violence that had sprouted up across the nation and Detroit in the late 1960s.

In addition to barriers to jobs and education, the Commission also identified the dynamic of who holds title to property as a contributing factor to civil unrest.

”Home ownership would… provide many low-income families with a tangible stake in society for the first time,” the Commission wrote. “We believe it is in the interest of the Nation to permit all who share such a goal to realize it.”

So, 50 years after the 1967 Detroit riots, what kind of assistance is being provided in the city to help people become homeowners and theoretically help keep the peace? How’s Detroit doing in terms of 21st century equity and lending?

REDLINING

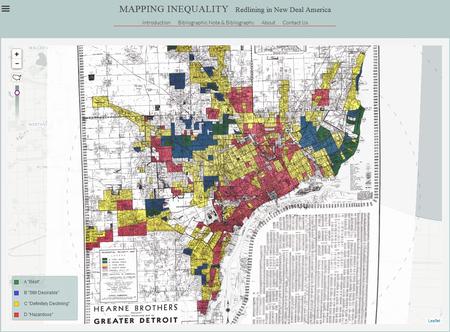

During the Great Depression, the federal government created maps to help banks and other institutions decide whom to lend to. The maps marked in red the areas officials considered the riskiest. Those tended to be predominantly African-American and other minority areas. Thus, the discriminatory practice of automatically denying financial services to people based on geographic location has become known as “redlining.” View interactive historic redlining maps of Detroit created for the “Mapping Inequality” project.

The Community Reinvestment Act of 1977 essentially outlawed redlining and encouraged banks to assist low- and moderate-income residents in the communities where they do business. But some people who study the housing market think mortgage lenders are unwittingly continuing the discriminatory practice today.

“They basically redlined the entire city of Detroit. No one will lend in Detroit,” says George “Mac” McCarthy, president and chief executive officer of the Lincoln Institute of Land Policy, a nonpartisan think tank based in Cambridge, Mass. He’s referring to the lack of mortgages that have happened in Detroit since the 2008 housing crisis.

City officials say about 3,000 homes sold in Detroit in 2015, but only about 500 were purchased with loans. This means roughly 85 percent were bought with cash.

If Detroit’s housing market is to stabilize, McCarthy says more mortgages need to be happening inside the city.

“Part of the way you get the banks to make loans is either with a carrot or with a stick” he says.

In 2012, one very large stick struck the nation’s five largest mortgage servicers. A historic joint state-federal settlement required Ally/GMAC, Bank of America, Citi, JPMorgan Chase and Wells Fargo to address mortgage servicing, foreclosure, and bankruptcy abuses by spending at least $17 billion on various forms of relief for homeowners.

But there have been smaller sticks too.

HomeLIFT

A settlement between Wells Fargo and the City of Westland Police and Fire System led to the bank agreeing to provide down payment assistance to areas like Detroit where properties were automatically sent into foreclosure without proper review. As a result of the settlement, Wells Fargo funded HomeLIFT, a program created in collaboration with NeighborWorks America.

“It’s $15,000 in down-payment assistance,” says Libby Palackdharry, the senior manager for financial stability programs at Southwest Solutions, the local development agency contracted to run the HomeLIFT program.

The assistance is available to people who are buying a home they will occupy in Detroit, Hamtramck, Highland Park, Dearborn or Livonia. The program is income restricted, so beneficiaries can only earn up to 120 percent of the median income level for their household size in the area. They also have to qualify for a loan with one of eight participating lenders. Plus, applicants must complete an eight-hour homebuyer education session with Southwest Solutions.

Palackdharry says the program helps people who might have decent credit but not a lot of savings realize the Detroit dream.

“Home ownership is still the main way households build assets and accumulate wealth in America,” she says. “Detroit is a city that was built around homeownership, there were a lot of factories and single-family homes that the workers were living in so our footprint is really designed for homeownership.”

According to Palackdharry, more than 140 homes had been purchased with HomeLIFT funds since the program launched in October 2015. Some additional 100 are in process, which leaves funding unclaimed for about 20 down-payment assistance loans. Palackdharry says of the five cities, most of the houses – roughly 60 percent — have been purchased in Detroit.

According to Southwest Solutions:

- 43 percent of homebuyers lived in Detroit prior to buying their home through HomeLIFT, with the rest divided throughout the metro area

- In terms of the race of the homebuyers, 55 percent are African American (non-Hispanic), 25 percent are white (non-Hispanic) and 8 percent are Hispanic.

- The median household income of homebuyers who have used the program is about $43,000.

Kenderes and John Class, the couple that had been renting in a basement, acquired their desired property with the help of HomeLIFT funds.

“When we bought the house, this room was covered with furry wallpaper,” says Kenderes. “It was peach and very texturized.”

Kenderes says they probably could have managed to purchase the house without the support of HomeLIFT but the down payment assistance has made a huge difference for them.

“We didn’t have to scrape as hard and we could put some money towards actually fixing up the house in the way that we wanted it to be,” she says.

That furry wallpaper, for example, is now a smooth wall.

Palackdharry points out that HomeLIFT is not the only home-buyer assistance program in town. The “Building Detroit” website (run by the City of Detroit) lists a handful of financial options including a down-payment assistance loan from Liberty Bank of up to $20,000 for Detroit Public School employees and a Detroit Neighborhood Initiative loan from the Neighborhood Assistance Corporation of America that does not require a credit score.

MIND THE GAP

One unique offering is the Detroit Home Mortgage (DHM) program, a partnership between the Community Reinvestment Fund USA, The Kresge Foundation, The Ford Foundation, the City of Detroit, Michigan State Housing Development Authority and participating banks.

DHM was developed as a way to address major issues related to mortgages in Detroit.

“There’s a cyclical cash market crisis in our city,” says Krysta Pate, the director of DHM.

Mortgage loan amounts are based primarily on the appraised value of a home. Banks determine this amount by looking at nearby, comparable sales. In Detroit, these tend to be cash sales which often depress prices.

“Essentially all the cash sales are very low and primarily [for] distressed properties,” says Pate.

This creates a problem when someone is trying to buy a move-in ready home. If the buyer and the seller agree on a price and then the house appraises for less, the buyer can usually only get a loan for the appraised amount. This usually means they need to come in with cash to make up the difference between the selling price and the appraised amount.

This is where DHM helps. The program, through five participating lenders, offers the opportunity for a second mortgage to cover this so-called “appraisal gap.”

The additional loan can alternately be used for renovations.

Unlike the HomeLIFT program, DHM is not income-restricted. Applicants need to qualify for a Federal Housing Administration loan, and they need a minimum FICO credit score of 600 (the national average score in 2016 was 695).

DHM potentially can be used on homes anywhere in the city of Detroit. Borrowers don’t have to be from Detroit but the home they purchase needs to become their primary residence.

Darnell Adams, the director of inventory at the Detroit Land Bank Authority, is one of the people who used DHM to update his new property. A millennial, Adams owned and lived in a house in Detroit’s East English Village when he decided to purchase a two-family flat in the same neighborhood to convert into a single-family home for himself.

He knocked out some downstairs bedrooms to expand the kitchen. He turned the master bedroom into a suite with a TV room and he’s finishing the basement.

“The renovation is going well. I’ve had zero incidents, knock on wood,” he says as he reaches over to knock on what looks to be wood original to the house, built in 1929.

Adams is using DHM to design a home that will meet his needs long-term.

“Someday I hope to grow a family and stay in Detroit,” he says.

With this being his first mortgage, he says he didn’t really know what to expect.

“It’s a lot of paperwork. A ton of paperwork,” he says.

Once he got all his documents in order, the process went fairly smoothly. Although, he says, the appraisers didn’t come out when they were supposed to, which stalled the process. Adams recalls there was also a lot of back and forth between the underwriter, the person who determines the riskiness of the loan and his lender, Huntington. But he says he learned a lot about the mortgage process.

“I think that Huntington also had a lot of lessons learned as well,” he says.

“IT’S CLUNKY”

Pate, the program director, says DHM just launched in February of 2016 and they’re still figuring out some best practices.

“Essentially we realize that it’s clunky,” she says.

They’re looking to better organize responsibilities so that loans can be processed at a quicker rate, and they’re hoping to find a way to better assist applicants who have student loan debts.

“Our banking partners, we actually work every Monday to work through issues,” she says.

Detroit Mayor Mike Duggan said at a press conference in February of last year that DHM will provide funding for 1,000 mortgages. But one year later, the program has only 23 closings: 12 of which were used to make renovations.

Detroit Home Mortgage Closings by Zipcode

Curious where houses are being bought using Detroit Home Mortgage? Take a look at the map below.

(Source: Detroit Home Mortgage)

Part of the reason that so few buyers have closed, according to Pate, is because the renovations portion can take up to six months. She expects to see the number of closings jump up as some participants complete their renovations in the coming months.

But still, 23 out of 1,000 is a low number. Pate is not deterred.

“Our plan is really to impact neighborhoods,” she says. “So, we feel that if we’re creating value in the neighborhoods as far as people renovating their homes and people being able to understand what true comparable sales are, as far as all of the cash sales in our market versus a home that’s finished and ready to go, that we will have an impact where some neighborhoods will become self-sustaining.”

The way she sees it, DHM enables houses to sell at their true value. This raises comparable sales numbers which means more and more home buyers will receive appraisals near the amount of their agreed-upon purchase price. This, in turn, should allow more buyers to qualify for conventional mortgages. The hope is that as home-buying continues in Detroit there will be less cash sales and more mortgages, which will be a good thing for potential buyers who have the credit scores, income and assets they need to obtain a mortgage.

New Mortgages Created in Detroit in 2015

Click on the colored census tracts below to see the number of new mortgages created in 2015, and the percent of those mortgages that were issued to African Americans.

(Source: HMDA)

McCarthy, who directed the Metropolitan Opportunity program at the Ford Foundation before joining the Lincoln Institute, says those watching as Detroit tries to find solutions to problems like the cash mortgage crisis should be asking one question: “Who is actually going to be inhabiting Detroit… 25 years from now?’”

Taking a look at current data may give us some indication of what lies ahead.

Using 2015 numbers from the Home Mortgage Disclosure Act, WDET created a map that shows where new mortgages occurred in the city (see above). Taking a look at some of the most active areas, the numbers show that new mortgages are not being distributed in a way that is representative of Detroit’s demographics, which is more than 80 percent African American. Of 57 new mortgages in the Grandmont-Rosedale and Brightmoor areas, 68 percent were created by African Americans. Of 139 new mortgages in the University District and Bagley areas, 54 percent were created by African Americans. Of 41 new mortgages in the East English Village area, 51 percent were created by African Americans. Of 204 new mortgages in the Downtown/Midtown area that year, only 16 percent were created by African Americans.