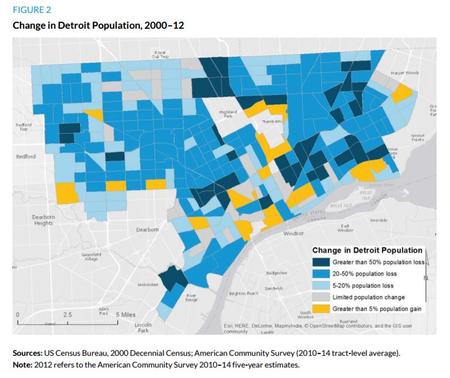

How’s Detroit Doing? Weak Demand, Insufficient Supply, Poor Credit Hurt Housing Market [CHARTS + GRAPHS]

Urban Institute says city needs innovative solutions to improve housing market.

Strong demand, a good supply of homes, and buyers with money and good credit are signs of a strong housing market.

Detroit has none of those things.

A new report from the Urban Institute finds the city suffers from having too many old, dilapidated houses, weak demand, and a population with poor credit.

Read the Urban Institute report here

Researcher Erika Poethig says one way to fix Detroit’s housing problem is to help residents improve their credit.

“62 percent of Detroit residents have subprime or no credit,” Poethig says, adding that debt is a significant burden, too. “32 percent of the debt held by Detroit residents is medical debt.”

Poethig also says the city should build on what it’s doing to improve the housing market, such as the Detroit Land Bank Authority’s “Rehabbed and Ready” program. She also says a housing “compact” would help unify efforts to stabilize the market, improve the quality of available homes, and build the financial health and credit of residents. Click on the audio player to hear the conversation.

Here are some figures from the Urban Institute’s report:

Detroit Housing Market Study by WDET 101.9 FM on Scribd