In November, Tax-Foreclosure Notices Were Dispersed in Wayne County. What Happens Next?

A local expert weighs in on what to do if you’re facing tax foreclosure.

Beginning this month, yellow notices have been going out to properties across Wayne County to tell homeowners with unpaid taxes and fees from 2016 that they may soon be facing foreclosure. If proper payment arrangements are not made, the properties are scheduled to be foreclosed in April 2018. Once foreclosed, properties in Wayne County are available to be auctioned off in September.

Michele Oberholtzer is the tax-foreclosure prevention project coordinator at a nonprofit called United Community Housing Coalition. WDET’s Laura Herberg interviewed Oberholtzer about the foreclosure process and the options that exist for residents and homeowners who might be in the middle of it.

Click on the audio player to hear an excerpt from that interview or read a longer transcript below.

Herberg – Let’s start with the very basics. What is tax foreclosure?

Oberholtzer – Tax foreclosure is the process by which the government takes ownership of private property when the owner doesn’t pay property taxes.

Herberg – Where are we at in the foreclosure process right now?

Oberholtzer – When these yellow bags go out on the doors of homes that are subject to foreclosure, that is the first step in the process of tax foreclosure. Each of those notices will give information to the owner of that property that the next step is to show up at the show cause hearing. [The show cause hearing] sounds like it’s a court hearing but it’s really not. It is an opportunity to get on a payment plan or receive assistance from non-profit partners that will be there.

Herberg – Tell me about what outreach efforts United Community Housing Coalition is involved in this year?

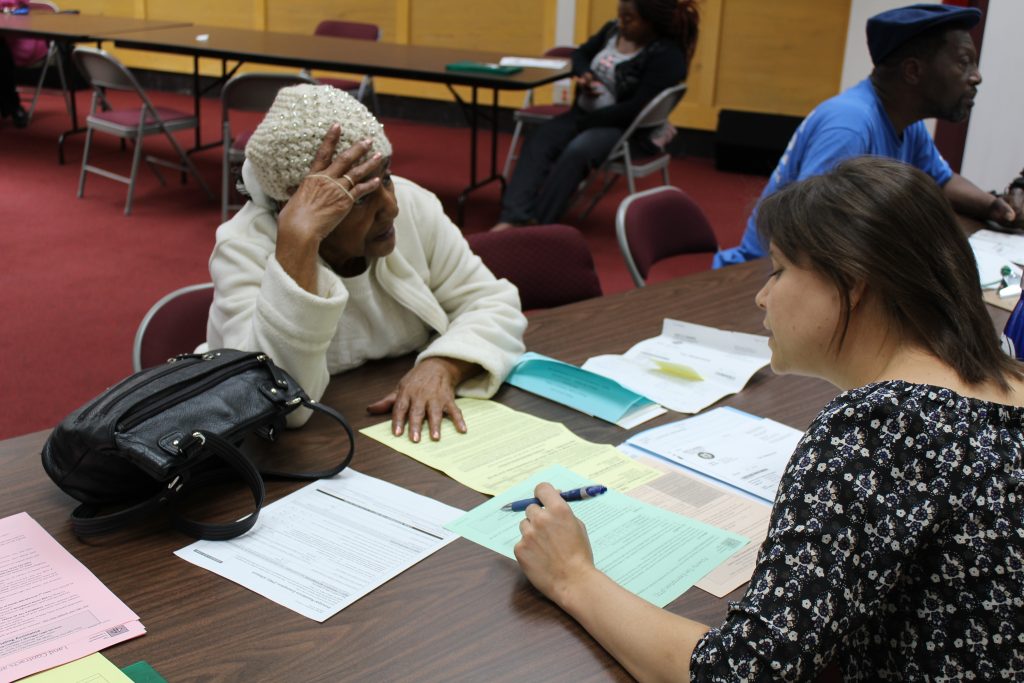

Oberhotlzer – As always, we are at our office three days a week to receive anyone who lives in a tax-foreclosed home in order to help them understand their options and receive counseling to make sure that they take advantage of every program that’s available and not lose their homes. We are also, as always, doing mass-mailing. Once we get access to the list of foreclosed properties we notify everyone of our services and of their options. We will be showing up at the show cause hearing that takes place in January.

Currently, there is a year-end effort with Quicken Loans and about 27 different neighborhood partner organizations where they are knocking on doors at tax-delinquent properties around the city. We’re going to be directing [homeowners] into counseling services in general, but also to seven different workshops which are taking place around the city.

The focus of those workshops is to make sure that before the year is over, anyone who is eligible for the HP TAP, the property tax exemption for low-income homeowners, takes advantage of that before the year ends. That’s so critical because there are people who will lose their homes for taxes that they could have been exempt from, and we need to make sure that they take advantage of that before it’s too late.

Herberg – You mentioned “HP TAP.” Can you explain what that is?

Oberholtzer – HP TAP (Homeowner Property Tax Assistance Program) is the new name for it. It used to be known as the Poverty Tax Exemption. City Council has passed a resolution to rename it because it was considered crass to call it the Poverty Tax Exemption.

Herberg – What should homeowners facing foreclosure know at this point in time?

Oberholtzer – Homeowners should know that there is time. They need to take this very seriously but it’s not too late. There is help available. We want them to save their homes, and they can do so in almost every case. But they really do need to be getting the information they need in order to save their home because the longer they wait the harder it is going to be.

Also, if you are a homeowner with a low income, it’s really important that you act in the next couple of weeks to get your taxes reduced for the year 2017. It’s a little bit counter-intuitive because we all know that the back-taxes are the ones that are threatening the houses with foreclosure, but we really want people to break the cycle of accumulating more debt. The priority right now is actually the 2017 taxes: try to get those lowered and then we can very seriously turn our focus on the back taxes.

There are payment plans available with the Treasurer. There is funding available through the state and federal funding sources which is sometimes difficult to get but we can really work toward getting it. And there are people who, for free, listen to their situation and make sure they have absolutely all of the information that they need to make a plan to save their home.

Herberg – You’re referring to counselors like yourself at United Community Housing Coalition, is that correct?

Oberholtzer – Yeah, I’m referring to counselors at UCHC. We are free housing counselors. Sometimes people call us and they say, “Oh you just to counseling?” and they’re very reluctant to take the time to come in. And I understand why but there are many people that pay taxes that they shouldn’t have to owe, lose their houses for lack of information, or get on the wrong payment plan because they lack one silly piece of paperwork. We want to make sure that never happens. We are advocates for residents. We will work with them and make sure that they unlock those funding sources and make sure that they take advantage of everything that they’re entitled to and deserve.

Herberg – What would you like to tell renters who have landlords who are facing foreclosure at this point in time?

Oberholtzer – I would like to tell renters that currently their landlord is still their landlord. Whatever is their rental agreement they should adhere to that. But before they pay their April rent they should check with the Wayne County Treasurer or with United Community Housing Coalition because as of April 1, the Wayne County Treasurer may be the landlord.

At that point it may be appropriate for them to withhold rent. This is a delicate thing so it’s really important to seek advice and counseling when you do this. But it is also important not to pay money to someone who is taking advantage of you. And it may be possible for them to eventually buy the home if it goes through foreclosure.

The other thing I would tell renters is that most properties that are subject to foreclosure don’t actually end up in the auction. And so just because they got that yellow bag, it’s not necessarily spelling out the fate of the house.

Herberg – Wayne County recently finished up the September and October auctions. Can you give us a summary of what came out of that process?

Oberholtzer – Once a property is foreclosed by the Treasurer, in most cases it ends up being in the Wayne County Tax-Foreclosure Auction. The auction happens in two rounds. The first round is in September, and the starting bid in that auction is whatever was the debt on the home, the back taxes. And if the house doesn’t sell in September it will go up for sale in the October auction where the starting bid is $500.

These auctions are increasingly appealing to investors and speculators. This year we saw extremely competitive bidding in the auction. Depending on your perspective, you may consider that this was a very successful auction because it raised money for the Wayne County Treasurer and other taxable entities. From the perspective of housing advocates, it was a very tragic auction because so many homeowners and residents were outbid, and homeowners lost their homes, and then renters who may have wanted to become the owners were unable to do so and are now often facing eviction. We are seeing a concentration of ownership in fewer and fewer hands as a result of the auction.

Herberg – Overall, how would you say Detroit is doing at preventing tax foreclosures?

Obertholtzer – That’s a very difficult question. I think that we are making an effort. I think that we are very far below a sufficient effort. I think that we could do much more, at all levels – city, state, county and as advocates. I think that we have unfortunately become accustomed to this very destructive process to the point that we genuinely celebrate when only 2,000 occupied homes are foreclosed. We need to greatly adjust and heighten our standards for what is acceptable in terms of foreclosure in the city. So, I would say we have a long way to go.

Herberg – What should be done that’s not happening?

Oberholtzer – I would like to see state legislative action that allows for the HP TAP exemption to be applied retroactively. I think that the city and the county can both advocate for that. I think the city could take advantage of the right-of-refusal [when cities buy properties before they go to auction] in a much broader way on behalf of current residents. I think that we could even use things like the bundling process to protect people from the competition of the auction.

In general we need to start recognizing the value of occupied homes and specifically of homeowners. We need to all be working to preserve and protect people in homes… and recognize it as an investment rather than a “hand out.”