Bridge Magazine: Neighborhood Advocates Challenging Development Incentive Decisions

The new federal tax plan has a program to steer development to poor neighborhoods. State officials are not designing it that way, Bridge reports.

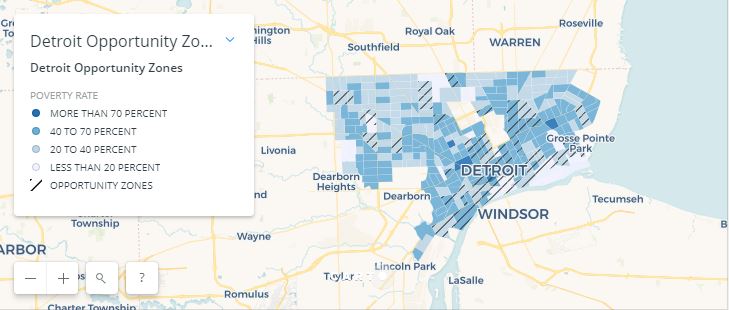

As part of the new federal tax plan, the Opportunity Zone program was created to give tax incentives for developments in some of America’s poorest areas.

But Michigan’s plans don’t always include locations with the most need, raising questions from some advocates who want to see the program address bigger equity and poverty issues. In a Bridge magazine article, Reporter Joel Kurth describes how Detroit and other Michigan municipalities are designing the program.

Click here to read the Bridge article.

Kurth spoke to WDET’s Sandra Svoboda about the Opportunity Zone and how Detroit plans to use the new tax program to build up the city.

Click on the audio player above to hear their conversation.

Here’s a transcript of it:

Joel Kurth: As part of the new Republican-passed tax plan of late last year, Opportunity Zones are being created throughout the nation that offer steep tax cuts on capital gains taxes in areas that are in or adjacent to Census tracts that have 20 percent or more people living in poverty. Taxes could save about $7.50 for every $100 of investment so it’s a pretty big tax break.

Sandra Svoboda: So how are the decisions being made in communities around Michigan about which areas would benefit from these development tax incentives?

Kurth: The state government is taking the lead on this. There are about 1,000 potential census tracts. By the rules of the program, only about one in four communities that qualify can be designated as Opportunity Zones. So the state is taking the lead. Areas like Grand Rapids and Detroit are offering input on what neighborhoods they think should qualify for these zones.

Svoboda: And how are cities making those decisions? How are they deciding what to put forth to the state about where those zones should be?

Kurth: In Detroit’s case, for instance, the whole city could qualify as an Opportunity Zone. So you can’t designate the whole city so they are trying to shore up areas that are stable such as downtown, Midtown, Grandmont Rosedale, Indian Village, southwest Detroit. That’s causing some debate about equity issues because there are a lot of areas in Detroit where poverty is 75 percent or higher.

Svoboda: What kind of arguments is the city of Detroit making about why those areas that do have growth and opportunity in them already should be part of this incentive program?

Kurth: The city’s philosophy under Mike Duggan has basically been to shore up vibrant areas in hopes that the growth spills over. There’s been some anecdotal evidence of success. In Midtown you’ve seen growth toward Milwaukee Junction and some of those other areas. But it’s causing a lot of consternation particularly in neighborhoods that aren’t part of these programs.

Svoboda: The deadline for this program is this week. What are the next steps?

Kurth: The next steps is the federal government is going to decide what areas are going to qualify and what aren’t. That could take several months.

One of the issues about this is everyone is saying this is a really accelerated program. The people that I’ve spoken to are complaining that there hasn’t been a lot of thoughtfulness and deliberation into the process. Now this program was created in late December, right before the holidays. The rules were promulgated in January. Here it is the end of March and we’re having to make decisions based on little tiny Census tracts all through Michigan. You’re seeing areas of Chelsea, Michigan that have 1 percent poverty that area being included in this program. Areas in northern Michigan, near the Mackinac Bridge in Emmet County are being included in this program.

A lot of the community development folks I’ve spoken to are saying “wait, let’s just slow down and try to figure out a better approach to this.” But it seems as though the state is eager to move forward and meet this federal deadline without asking for a delay or any kind of deadline extension

Svoboda: How will you be monitoring this going forward as the program comes in and the money comes in and the incentives are distributed. What kinds of things should you watch for in your watchdog role as a journalist?

Kurth: Well this is an issue that’s really been, especially in Detroit, has been promulgated time and time again. We’re seeing it in development, in areas of priority. We are keeping an eye on how federal tax dollars and how federal tax breaks are being spent, particularly in Detroit because this has increasingly become a question of equity and people saying there’s a have- and have-not situation in Detroit.