BOOK CLUB: How Tax Foreclosure Impacts Stability In Metro Detroit

A recent settlement between the city of Detroit and the ACLU of Michigan offers lifeline to homeowners behind on taxes.

This week begins Detroit Today’s on-air discussions about eviction and housing insecurity in southeast Michigan as part of WDET’s summer community read of Evicted by Matthew Desmond.

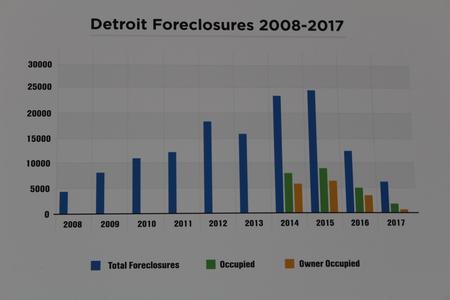

This week’s topic is one of the most critical forms of eviction residents in Metro Detroit face — that is, the loss of home through tax foreclosure.

It’s fitting to start here because people living in the region have struggled mightily with falling behind on their taxes, and then losing their homes for those tax debts.

Programs have been put in place in Wayne County to curtail the number of homes lost through the auction process after it’s been tax foreclosed.

Just last week the city of Detroit settled a lawsuit with the ACLU of Michigan, who was suing to stop people from losing their homes through the tax foreclosure process. The settlement will allow many people to keep their home if they can pay $1000 on any amount of tax debt.

Vicky Kovari, general manager of Detroit’s Department of Neighborhoods, speaks with Detroit Today host Stephen Henderson about working to reduce tax foreclosures in the city.

On the focus and result of the settlement:

“The lawsuit focuses on owner occupants, which is a really key part of it, and then just gives us more tools by streamlining the poverty tax exemption process to open doors for folks that are truly at need and have no or little means to keep their homes,” says Kovari.

On the city’s history of unfair overassessments:

“There’s no doubt that there were overassessments and I think that we have tried, at least as much as it was in our power, to correct those inefficiencies or deficiencies in the past.”

Michael Steinberg, legal director of the ACLU of Michigan also joins the program. Steinberg was part of the lawsuit the ACLU filed against the city of Detroit.

On the focus of the settlement and what went wrong:

“People were losing their homes for inability to pay taxes when they actually qualified for the poverty tax exemption,” says Steinberg. “In Detroit if your income falls below the federal poverty guidelines, you should be paying zero dollars in taxes, zero.”

“Most people who qualified didn’t even know about the program, it was almost a secret and even those who knew about it had many unfair obstacles to obtaining the benefit of it.”

Click on the audio player above for the full conversation.

To learn more about Detroit Today’s summer book club click here. Our first in-community event is Tuesday, July 17th, at the Ann Arbor District Library from 6:30 p.m. to 8:00 p.m. Stephen and guests will discuss the book EVICTED and will focus on the complexities of subsidized housing for low income residents.