Study: Uncollected Property Tax, High Rates Holding Detroit Back

Detroit’s recovery stalled by delinquencies, poor assessment, state laws, new report finds.

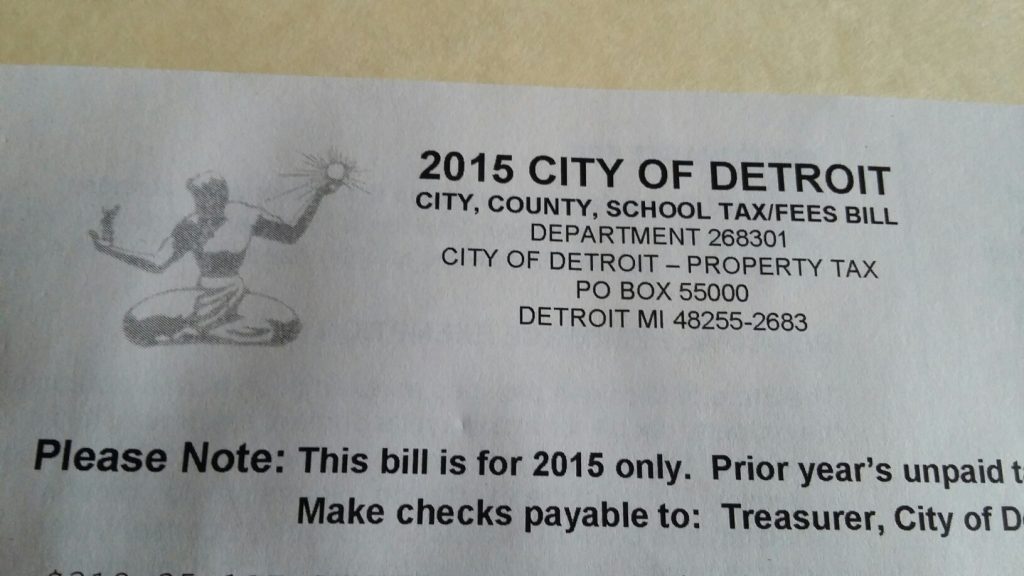

Uncollected property taxes, a poor assessment system and high tax rates are hindering Detroit’s comeback, according to a new report from the Lincoln Institute of Land Policy.

Co-author Gary Sanders, professor emeritus in Wayne State University’s Department of Urban Studies and Planning, estimates the total amount of uncollected property taxes is more than $100 million. That’s nearly a tenth of the city’s budget.

“It’s a serious problem because property prices are depressed and property values are down as a result of the general economic conditions,” Sanders says. “And even if things start getting better, it’s going to be a slow climb back up from where they are now.”

The report is titled “Detroit and the Property Tax: Strategies to Improve Equity and Enhance Revenue.”

Sanders says uncollected property taxes are just one of several issues holding the city back. The report offers several suggestions for fixing the problem including improving tax abatements and implementing a land-based tax.

Mayor Mike Duggan has implemented a re-assessment of the city’s residential property. While the overall value is down — meaning less tax will be collected — Duggan and other city officials this year have said tax collection rates are rising creating an overall gain in revenue.

Detroit and the Property Tax: Strategies to Improve Equity and Enhance Revenue: