Expert: House Tax Plan Won’t Help Many in Michigan

Mich. St. econ prof: House tax plan aids wealthy estates, stock portfolios, does little for workers w/ $50,000 incomes.

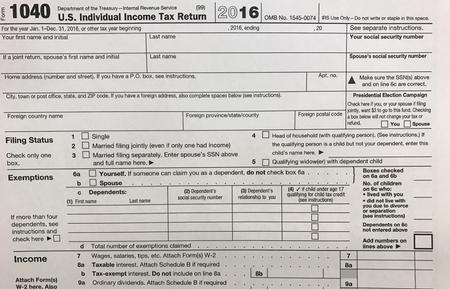

The U.S. House is likely to hold a much anticipated vote to reform the nation’s tax code today.

Members of Congress are split along partisan lines in their views of just how much the plan will help the U.S. economy.

Or U.S. taxpayers.

Michigan State University Economics Professor Charles Ballard says the impact on people in the Wolverine state will depend on what tax bracket they are already in.

“If you got a lot of wealth it’s good for you because it would repeal the estate tax. But that only applies to married couples with more than $11 million, so that’s a very small portion of the population,” Ballard says. “If you have a big stock market portfolio it’s good for you because the corporate tax cut is likely to boost the stock market. For the average person it really doesn’t do a whole lot.”

Ballard defines “average” workers as those earning between $40,000 and $70,000 a year.

Republicans like Michigan Congressman Fred Upton counter that the plan will aid those workers because it will help companies create more jobs.

The Trump Administration is also pushing for Congress to pass tax reform.

Experts note that the GOP needs a legislative victory to show it can produce while holding both Congress and the White House.

That’s especially significant after Democrats won several key electoral races in recent weeks.